Economic and Social Development

Economic and social Development

Syllabus -

Meaning of Economic and Social Development. Human Development

Index (HDI) and Human Poverty Index (HPI).

Characteristics of Indian Economy : Before and After Independence.

Census of India : Economic and Social features.

Population growth and economic development. Issues related to Role of

women in Economic and Social Development in India.

Impact of globalization on Indian society : Poverty and Development.

Poverty-line and Programmes for eradication of Poverty in India.

Schemes for Rural and Social Development - Welfare and Developmental

Programmes including Self Help Groups (SHGs), MNREGA and

community power structure.

Sustainable development and Inclusive growth.

National Income - Measurement and composition.

Regional imbalances and income inequalities in India : Steps taken by the

Government to reduce it.

Characteristics of Indian Economy : Before and After Independence

The economic history of India shows a number of distinct phases over the period it fell under the colonial control to the modern times when it embarked on economic reforms. Before the formal onset of the British colonial rule in India after the battle of Plassey in 1757, India was among the richest countries of the world. According to some estimates during the Mughal period India was the second largest economy having a share of almost 25% of the world economy. Two centuries of the exploitative British colonial rule led to India's wealth being drained away and the process of 'deindustrialisation' taking a heavy toll on the people of India. The great nationalist leader Dadabhai Naoroji was the first person to systematically highlight this aspect of the colonial exploitation. His analysis laid the theoretical foundation for the freedom struggle culminating in India's independence in 1947.

At the time of independence, India inherited a stagnant economy. Between 1900-1950, the

real GDP growth rate of India was almost zero. The independent India embarked on a process of economic reconstruction and growth by adopting the model of planning. The beginning was made with the Mahalnobis-Feldman model which aimed to build the capital goods industry to lay the foundation for self-reliant growth in India.

However, beginning the 1980s winds of change had started blowing across the world in the form of greater international economic integration in the process of globalisation. India realised that its growth rate, sarcastically dubbed the 'Hindu growth rate' of close to 3% annually, was far too low to sustain the expanding aspiration of its people. The distortion in the planned economic process was glaringly reflected in the 'license-permit raj' that empowered the rent seeking class of bureaucrat-contractor-politician to extract surplus from the system. This was the period when economic reforms were initiated, prompted in no small measure by the expanding sphere of finance capital in the world economy.

The process of economic reforms picked up momentum by the early 1990s as India had to undergo structural adjustment in order to avoid defaulting on its international obligations towards debt repayment. The reforms moved apace to include opening up of the economy, decontrol and significant changes in the financial and banking sectors. The

transition from the public sector attaining the 'commanding heights of economy' to the 'market driven open economy' has been a complex and multi-layered process. The transition has indeed resulted in an accelerated GDP growth rate of above

5% for the period 1991-92 to 2003-04 and above 6% for the period 2003-04 to 2011-12. Fall in the poverty ratio, improvement in the FDI and better forex reserves have also been noticeable achievements of this period.

However, this period has also been marked by an increase in the level of inequality in the country. According to a study 'in both the early 1990s and the early 2000s the wealthiest 10% of wealth-holders held at least 50% of total assets, while the least wealthy 10% held at most 0.4% of total assets'. In case of land, it is more unequally distributed than wealth as a whole. The ownership of financial assets is even more concentrated, as 'almost all financial

wealth is held by well below 1% of the population'. It needs to be highlighted that inequality in resource endowment also culminates into inequalities of opportunity which defeats the purpose of inclusive development that India has adopted as a stated objective of its economic policy. There has also been a serious concern about employment generation in the period of economic reforms. The robust growth rate has not really been accompanied with improvement in the employment generation. Similarly, share of manufacturing sector in the GDP has also been quite low at 16%, putting a structural constraint on the future prospect of growth with employment.

Indeed, the rights based model of inclusive development could be successful only when we are able to bring in larger and larger number of people in the 'circuit of capital' for their productive integration in the process of creation of national wealth. After all, the famous economist Joan Robinson has rightly remarked that 'what is worse than being “exploited” is

not to be exploited at all!'

Economic Growth In India – Performance and Prospects

The most comprehensive indicator of economic growth in an economy is the average annual growth in real Gross Domestic Product(GDP) that is originating within the geographical boundary and measured at constant base period prices. It would, therefore, reflect average incremental availability of goods and services produced domestically in the economy over time. When the growth of real GDP is adjusted for the population growth, it gives the average annual growth of per capita real GDP and reflects closely the improvements in standard of living enjoyed by people in the economy on an average over time. This is particularly valid for large countries where the cross border flows of goods and services are limited in relation to the amount produced within the geographical boundary. These three average annual growth rates in: (i) real GDP, (ii) population and (iii) per capita GDP (PCI) are very significant parameters to reflect the performance and prospects of economic development in any country over fairly long time period.

History of economic growth in India is both interesting and educative. Comparable time series estimates of real GDP in India can be stretched back till the year 1900 for meaningful analysis (Sivasubramonian, 2004; and Hatekar & Dongre, 2005). There is considerable research on attempting periodization of the economic growth history in India to gain insights about policy regimes and factors determining the performance of the economy over long periods of time (Hatekar & Dongre, 2005; Balakrishnan & Parameswaran, 2007; and Dholakia, 2014). Accordingly, there are five distinct phases so far in the history of economic growth in India: (i) 1900-1901 to 1950-51; (ii) 1950-51 to 1980-81; (iii) 1980-81 to 1991-92; (iv) 1991-92 to 2003-04; (v) 2003-04 to 2011-12.

The growth performance during the first phase when the country was under the last 50 years of the British rule was the worst during all the phases so far. Real GDP grew at around 1 per cent annually and so did the population. As a result, the per capita real income almost stagnated for the first fifty years of the last century in India. Since the last fifty years of the British rule in the country were perhaps the best period for the Indian economy under their rule of about 190 years in terms of development of all physical and social overhead capital such as railways, ports, schools, colleges, hospitals, banks and other institutions, it can be safely assumed that the stagnation of real living standards of people observed during 1900-51 was perhaps the phenomenon during the entire period of 190 years of the British rule in the country. These two centuries of stagnation ensured that one of the richest countries in the world luring everybody by its wealth and prosperity turned into one of the poorest countries by the year 1950-51.

The stagnation of real per capita income for such a long time also had other implications. Under such circumstances, if anyone becomes better off, it cannot happen without someone else becoming worse off, because it becomes a zero sum game under stagnation. Therefore, in the society people started looking at progressing few with suspicion that they would have been involved in some wrong doing to become rich by depriving others or snatching opportunities from others making them poorer - a perception that continues even today! Social and cultural barriers to entrepreneurship became stronger and economic growth in the nation further suffered. Moreover, long stagnation in the living standard of masses implies that their consumption pattern would not change significantly, and because there would be hardly any innovations or technological progress in the system, people would continue to consume the same products throughout their life with little diversity and change. Rate of product obsolescence and depreciation was very small and the culture of preserving things by recycling, saving resources and using outdated technology with low material costs was widely prevalent.

After achieving independence, it was a major challenge to break out from such vicious circles of low level equilibrium. Committing ourselves to achieving self-sufficiency in general and the socialistic pattern of society by adopting both economic and physical planning through creation of public sector undertakings and imposing numerous controls, licenses and high taxes, during the second phase (1950-81) we achieved the breakthrough largely through public sector interventions. In terms of managerial decision to buy or make, the national commitment to self-sufficiency implied complete focus on import substitution without consideration to cost of production. It was consistent with the export pessimism subscribed by most of the leaders of those days. Although our share in world exports started falling significantly, the real growth of GDP increased to about 3.5 per cent annually over the 30 years period, 1950-81. Because of a sharp fall in the death rate due to improved provisioning of primary healthcare infrastructure in the rural areas, the growth of population also increased substantially to about 2.2 per cent annually and the per capita income registered annual growth of meagre 1.2 per cent. It marked an increase of about 2.5 percentage points in the annual growth of real GDP, but only about 1.2 percentage points in per capita real GDP.

The need for reforms in economic policies was duly recognized in India in the early 1980s, not substantially lagging behind China. Several economic reform measures got initiated during the 1980s with exchange rates adjusting continually for differences in the inflation rates, change in the approach of monetary policy to monetary targeting, instituting new institutions in financial sector, announcement of long-term fiscal policy, reducing quota requirements in selected commodities, focusing on telecom & information & technology sector, etc. The economic growth during the third phase( 1980-81 to 1991-92) further picked up from 3.5 per cent to 5.1 per cent annually and the population growth fell to about 2 per cent. Per capita real GDP, therefore, started growing at more than 3 per cent annually during the 1980s.

The fourth phase(1991-92 to 2003-04) saw accelerated pace of implementation of some systematic economic policy reforms in various segments of the economy such as fiscal policy, autonomy of the Reserve Bank of India (RBI), commercial policy, capital markets, aviation sector, banking and insurance sector, etc. Sequencing of the reforms was meticulously done starting with privatizing selected sectors by allowing participation by the private sector into those activities reserved hitherto for only the public sector undertakings, liberalizing economic activities by abolishing licensing requirements, gradually reducing protection by cutting tariff rates to integrate domestic economy with the international economy, allowing foreign direct investments in the economy and finally allowing domestic players to go global and become multinational companies. The growth of real GDP further increased during this phase to 6 per cent and per capita real GDP to more than 4 per cent annually.

During the last phase so far covering the period 2003-04 to 2011- 12, although no major economic reform took place, the economy was allowed to consolidate and adjust to the reforms already made initially for 5-6 years. However, during the last 4-5 years, some reforms got reversed effectively by introduction of new controls, regulations, approval requirements, bans, environmental and ecological balance oriented clearances and so on. Favourable global factors prior to the year 2008 coupled with easy monetary policy and movement towards fiscal consolidation resulted in high growth.

Annual growth of real GDP increased further to 8.4 per cent and per capita real GDP to more than 6.5 per cent. Interestingly, critical areas of pending reforms such as labour reforms, land market reforms, foreign direct investment, direct & indirect taxation reforms, expenditure reforms and so on are yet not satisfactorily addressed. These represent the opportunities for future growth of the economy.

Prospects For Indian Economic Growth

In the recent past, the best economic performance of the Indian economy was achieved during the year 2007-08. It is important to note some relevant parameter values during the year because they have been actually achieved by the nation in not too distant past and, therefore, can easily be achieved again. It represents the lower bounderies on the potential existing in the economy. In 2010-11, we came very close to achieving several of those parameter values, which indicates the feasibility and practicality of such a potential existing in the economy at present.

In 2007-08, the Indian economy clocked the growth of 9.3 per cent in real GDP at factor cost, exports growth of 29 per cent in dollar terms, inflation rates of 4.7 per cent (Wholesale Prices) & 6.2 per cent (consumer prices), foreign exchange reserves of $310 billion equivalent, average exchange rate of Rs. 40.3 per dollar, current account deficit of only 1.3 per cent of GDP, combined fiscal deficit of 4 per cent of GDP, combined revenue deficit of 0.2 per cent of GDP and primary surplus of 0.9 per cent of GDP. Thus, the year 2007-08 was outstanding in all relevant performance parameters except consumer inflation. This was made possible primarily because domestic savings rate and domestic investment rate reached their respective peaks at 36.8 per cent and 38.1 per cent of GDP. The Incremental Capital Output Ratio (ICOR) reflecting the efficiency of converting capital formation into growth of output was around 4.1.

The performance of the economy slipped on all these parameters sharply after the year 2007-08. International developments in terms of financial & confidence crisis of 2008, increase in commodity prices including oil prices, Eurozone sovereign debt crisis, etc. led almost all developed economies into severe recession and most of the developing economies to a significant slowdown. Both fiscal and monetary boosts were provided all over with a significant collaborative effort to emerge out of such a slump. Indian economy could fast recover and emerged out of the slowdown initially in terms of regaining the growth momentum, but failed to reign in the inflation, twin deficits on fiscal & current account, steep depreciation of the currency and loss in foreign exchange reserves. Public sector savings fell sharply from 5 per cent of GDP in 2007-08 to 1.3 per cent in 2011-12. Savings of the private corporate sector also fell from 9.4 per cent of GDP in 2007-08 to 7.2 per cent in 2011-12. As a result, overall savings rate in the economy fell by 6 percentage points to 30.8 per cent of GDP in 2011-12 from 36.8 per cent in 2007-08. Investment rate also fell from 38.1 per cent of GDP in 2007- 08 to 35 per cent in 2011-12 and 32.3 per cent in 2013-14; and the growth of real GDP came down to 6.2 per cent in 2011-12. ICOR increased to 5.6 indicating substantial deterioration in the efficiency of capital resources that can occur only if the investments remain under or unutilized.

The government’s failure to take several decisions of critical importance and urgency to ensure proper utilization of natural resources and capital investments in areas of strategic importance such as infrastructure provision, raw material supplies, taxation, providing environmental clearances, giving timely approvals for projects with huge investments, etc. resulted in sharply reducing capital efficiency and consequently increasing the ICOR in the system. From the economy’s potential assessment angle, all these factors are of temporary nature and can get reversed very fast. If the central government starts performing by taking quick decisions and clearing the pending cases of approvals, it may not only provide good incentives for additional investments from the private corporate sector but also lead to improvements in utilization rates of existing projects. All this can result in reducing the ICOR back to the level achieved in 2007-08. Similarly, the central government can reign in the fiscal discipline soon to ensure a rise in the public sector saving back to the level of 2007-08.

Thus, achieving the domestic savings rate of 36.8 per cent in near future is very likely. Then, attaining the investment rate of 38 per cent is also quite feasible. However, the future potential of India is far more attractive, because India is among the few economies currently in the world enjoying the demographic dividend. The proportion of population in the employable age group of 20 years to 65 years is on the rise in the country and is likely to continue rising till about 2027-28 as per the UN projections. Thereafter it may stabilize for a while and then start falling. To attain the current level of the ratio, it may take another 15-20 years because the life expectancy in the country is also likely to rise in the meantime, but the further rise would be necessarily slower as we achieve higher levels. Since the dependency ratio would be falling in the country till 2027-28, domestic savings rate is most likely to rise further to reach the levels already reached in south-east Asia of 40-42 per cent of GDP. If the efficiency of capital resources is maintained with the ICOR staying at 4.1, this in itself would generate an annual growth rate of 10 per cent of real GDP. This is purely domestically funded growth potential. We expect that such a high growth momentum is most likely to attract huge foreign investment in search of better returns and dynamic markets. Similarly our companies would reach out to foreign destinations to expand their markets. If we assume a net inflow of only 2 per cent points, it would push our annual growth potential upward to 10.5 per cent over a fairly long period unto 2050.

Population growth rate is likely to slow down considerably and would be about annual 1 per cent on average. Then the per capita real GDP is likely to grow at around 9 per cent annually. This is a mind-boggling scenario where the per capita real income would be doubling every 8 years. The availability of goods and services would be increasing at an unprecedented rate and so would be the consumption of people. With such a high speed of expansion in the consumption basket, the consumption pattern would be changing drastically and rapidly. The basket would be highly diversified and ever changing. Rate of product obsolescence and depreciation would be very high. Preserving goods would not be found viable and feasible. Recycling of products and resources could become a formal business but affording it within the household could be almost ruled out. Service sector, entertainment, information, communication, research and development are the fields most likely to come to prominence. In short, the first fifty years of the current century are likely to be quite opposite to the first fifty years of the last century in India.

In such a dynamic and fast pace of economic growth, entrepreneurship and diversity of consumption would require considerable resources devoted to research and development. This would require qualitatively a much superior human resource development strategy. For a business enterprise, to survive and maintain one’s relative position, rapid growth in labour productivity, technological improvements and emphasis on exclusive products would be the key. Emphasis and reliance on the private sector participation is likely to address most of these concerns as a part of their self-interest.

Is India back to the Hindu Growth Rate?

India’s post economic reforms growth has been one of the most cited examples by economists in last many years. A h l u w a l i a ( 1 9 9 5 ) , Srinivasan (2002), Stern (2004), Virmani (2004), Tendulkar and Bhavani (2007), Panagariya (2008), Bhagwati and Panagariya (2012.) to name a few are among some of the leading contributors in this regard. India was blamed for its inwardlooking industrialization from 1950-90. Growth got a new boost from India’s macroeconomic reforms when it moved from inward looking to outward looking industrialization. This was in anticipation of the policy makers that Indian economy would achieve faster economic growth. But, the growth in the post reforms period has become a matter of debate. Economists argue that India is an open economy where the Hindu Growth Rate is far from the reality. To get an external linkage in this particular paper, the Pearson correlation coefficient (r) finds the strength of the linear relationship between the GDP Growth and trade deficit in India.

Growth Rate vs. Hindu Growth Rate

Economic growth is defined as the steady process by which the productive capacity of the economy is increased over time to bring about rising levels of national output and income (Todaro and Smith, 2003). Samuelson and Nordhaus (2007) assert that economic growth represents the expansion of a country’s potential GDP or national output. Soon after the independence, Indian Economy was facing chronic imbalances as part of colonial rule. Indian economy was left with weak industrial base, poor infrastructure and static economy. India made the first declaration of industrial policy in theirresolution dated 6th April, 1948 in which both public and private sectors had been given importance.

India followed the planning model that was adopted in socialist countries including former USSR. In tune with the socialist central planning model, India started its planning beginning from 1951. However, the development of industries was left in shadow during first five year plan. The gloomy picture of industrialization and sub normality as part of industrial development can be traced through the facts. According to the 1st Five Year Plan, on the one hand, factory establishments in the country accounted for merely 6.6 per cent in 1948-49 as a proportion of national income and on the other, only 1-8 per cent of the working population were engaged in these establishments.

A new industrial policy statementwas announced on 30th April, 1956 (The Industrial Policy of year 1956 is known as ECONOMIC CONSTITUTION of the country.). It was aimed at accelerating the process of industrialization and specifically developing large scale heavy industries. The new revised industrial policy includes Schedule A and Schedule B. Schedule A included industries which were the exclusive responsibility of the state - monopoly of the state. Schedule B included mixed sector of public and private undertakings. All the rest of the industries were left for the private sector to establish and operate.

The Second Plan(1956-61) was particularly in the development of the public sector. The plan followed the Mahalanobis model, an economic development model developed by the Indian statistician Prasanta Chandra Mahalanobis in 1953. Hydroelectric power projects and five steel plants at Bhilai, Durgapur, and Rourkela were established. Coal production was increased. More railway lines were added in the north east.The Tata Institute of Fundamental Research was established as a research institute.

The Third plan(1961-66) was largely devoted to long run benefits and was in tune with the objectives of increase in the national output and income generating huge employment. The focus was on the development of capital and producer goods industries. It also emphasized on the development of machine-building industries. However, the growth rate of industrial output declined, initially at slow pace and after that, it decelerated sharply reaching stagnation levels. This created serious concerns for nearly three years when the economy fluctuated. The year 1968-69 showed a clear sign of recovery. Fourth Five Year Plan (1969-74), was marked by a very low growth in industrial production of 3.9 per cent against the targeted rate of 8-10 per cent.

Fifth Five Year Plan(1974-79), started in 1974, proposed to achieve growth with the attainment of self-reliance. The emphasis was on the industries of core-sector like- iron & steel, nonferrous metals, fertilizers, mineral oil, machinery-building, coal and others. The economy was faced with pressures and the industrial growth rate was low at 2.5 per cent in 1974-75. It was 5.7 per cent in 1975-76 which provided some relief for the economy.

Sixth Five Year Plan(1980-85) was started in 1980. Substantial policy changes were announced during this plan. The Sixth Five-Year Plan marked the beginning of economic liberalisation. Price controls were eliminated and ration shops were closed. This led to an increase in food prices and an increase in the cost of living. This was the end of Nehruvian socialism. Industriallicensing and controls were relaxed and import policy was more liberalized than ever before. The result was that growth was witnessed in industrial production. Seventh Five Year Plan was started in 1985.The emphasis was on development with growth and increase in productivity. The industrial growth rate during this plan was 8.5 per cent against the target of 8.4 percent. Thus, it was successful on the part of industries.

Ahluwalia (1995) pointed out that the inadequacy of the growth performance of the Indian economy led Prof. Raj Krishna to coin the much quoted phrase 'the Hindu rate of growth, to specify the disappointing trend of growth. The Hindu growth rate has nothing to do with any specific religion; rather it is a term that was economic in nature. It was a caustic remark on the socialist pattern that was adopted by the government after the Independence. It was an indication of low and almost stagnant growth of Indian economy during 1950s to 1980. The average annual growth rate of GDP during this period was 3.5 per cent. The growth rate of GDP has shown in table1:

GDP growth rate from 1950-1979

Decades GDP growth Rate

1950-59 3.3

1960-69 4.4

1970-79 2.9

1950-79 3.5

Virmani (2004), asserts that the new economic policy introduced in 1991-92 had changed the Indian economy and pushed it from the Hindu rate of growth to a new higher rate of 5 per cent-6 per cent, called as, new Hindu rate of growth.

Slow-down Growth Linkages

Growth potential of Indian economy can be gauged in two ways: quantitative and structural. To understand the quantitative aspects, growth rates of different sectors and overall GDP growth are considered. But to understand the economy well, structural aspects have to be considered. Changes in sectoral distribution of GDP give the more realistic account on the part of economic growth of the country. Agriculture dominated the sectoral composition of the GDP till 1970. In 1950-51 agriculture and allied sector’s share in GDP was 55.3 per cent. Two decades of planning in India, did not show any significant decline in the share of agriculture and allied sector. This was the manifestation of the fact that industries were indeed in a bad condition in India. The process of industrialization was not smooth and not contributing significantly.

Growth Trends after Reforms

The crisis of 1991 led the Indian policy makers to think beyond the policy of import substitution to outward oriented export promotion model. The Indian economy was integrated with the economies of the world. Reforms were initiated in industrial policy and foreign investment policy, trade and exchange rate policy, tax reforms, public sector policy, financial sector reforms, reforms in agricultural sector, labor market reforms and others. The results of these reforms were seen soon after the reforms. The GDP growth rate which was merely 1.43 per cent in 1991-92, increased to 5.36 per cent in 1992-93.

Agriculture & Allied Sectors

Indian economy was heavily based on agriculture. Its importance can be evaluated on two grounds- share in GDP and in employment. So there is a need to address the problems of agriculture. The low production and productivity poses constraints on the total output of agriculture. The inefficiency on the part of agriculture merits sound policy implications and investments. A very alarming characteristic of agricultural sector is that real investment in agriculture, both private and public, has been stagnant (Ahluwalia, 1993). This, with other structural factors, led to slow growth in agricultural and allied sector.

Industry

The economic reforms were more radical as far as industries were concerned. Changes in the policy framework gave a big boost to industries. The major reforms were the abolition of licenses to a wide range of industries. Licenses are required now only for some industries. Industries have thus grown significantly during the last two decades after the reforms. Average growth rate from 1991-92 to 2010-11 was 5.7 per cent with a peak growth of 12.17 per cent in 2006-07 and lowest of 0.34 per cent in 19991-92.

Service Sector

The service sector in India after the reforms has dominated the sectoral composition of GDP. The share of services in 1991-92 was 43.9 per cent which rose to 59.29 per cent in 2012- 13.There is a sharp increase in IT, telecom, banking service, insurance, entertainment and many more. But, it’s also true that only few services are performing well. Today, India is well known for IT and IT-enabled services (ITES), communication and BPO. The growth of service sector after the reforms shows a relatively smooth trend compared to agriculture and industries. The growth rate which was 4.69 per cent in 1991-92, started increasing and witnessed double-digit growth in several years.

Performance of Indian Economy

There are different phases of growth of Indian economy. Before 1980s, there was relative stagnation in the economy, with average growth rate of GDP at 3.5 per cent. Partial reforms were started during 1980s. But total reforms were initiated only after 1991. The currency crisis of 1990s compelled the policy makers to initiate the reforms. GDP started peaking after reforms.

External Linkages

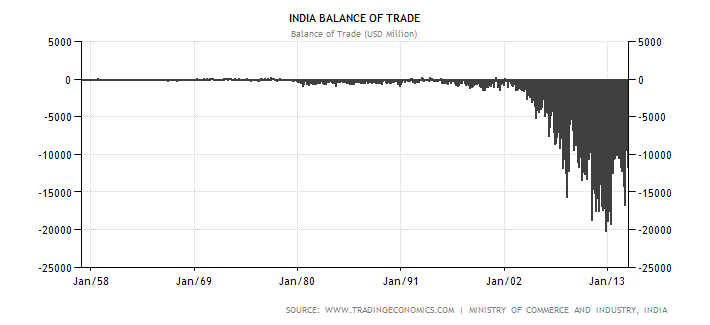

Domestic sectors have been discussed till now. To analyze the economy completely, it is imperative to understand the external linkages of growth also, comprising exports and imports. Trade balance remained negative since long. There has been trade deficit in the balance of payments account. Below diagram shows trade balance and GDP growth rates from 1957 to 2015.

The correlation coefficient between GDP growth rate and trade deficit is found to be 0.58. This indicates that there is a moderate positive relationship between these two. The value of correlation coefficient shows that when GDP increases, India’s trade deficit also increases (though moderately), indicating that the exports are not responding as fast as compared to imports. These growth rates indicate that the reforms had certainly brought more imports which has contributed in our growth because such range of growth rate (1991-2010) has not been achieved by India before trade liberalization started in 1991.

Recent Growth Trends

The Indian economy is facing problems that are reflected through the facts released by the Ministry of Finance, Department of Economic Affairs during recent couple of years. Quarterly data released from 2010-11 to 2012-13 related to the growth rates of agriculture & allied sector industry and service sector have been shown in Table 5. Agriculture & allied sectors have been performing poorly. This is the most fluctuating sector – growth rates have fluctuated between peak rates of 11.0 per cent in quarter 3 (Q3) of 2010-11 to mere 1.2 per cent in quarter 2 (Q2) of 2012-13. Average growth rate during this period was 3.4 per cent. Industrial sector is also a matter of concern for the policy makers and the government. Industries have grown on an average of 4.4 per cent during Q1 of 2010-11 to Q2 of 2012-13. However, service sector shows a steady trend during this period. Average growth rate in this sector stood at 8.6 per cent. Overall GDP growth rate during this period was 6.9 per cent.

Conclusion

Compared to the pre reforms era, Indian economy had much faster economic growth in the post reforms period. But, the recent revised forecasts released by ADB and others on the growth of Indian economy provide a glimpse of slow down of Indian economy. Agriculture and allied sector is still a matter of concern as it is the most fluctuating sector in the Indian economy.

Economic and social Development

Syllabus -

Meaning of Economic and Social Development. Human Development

Index (HDI) and Human Poverty Index (HPI).

Characteristics of Indian Economy : Before and After Independence.

Census of India : Economic and Social features.

Population growth and economic development. Issues related to Role of

women in Economic and Social Development in India.

Impact of globalization on Indian society : Poverty and Development.

Poverty-line and Programmes for eradication of Poverty in India.

Schemes for Rural and Social Development - Welfare and Developmental

Programmes including Self Help Groups (SHGs), MNREGA and

community power structure.

Sustainable development and Inclusive growth.

National Income - Measurement and composition.

Regional imbalances and income inequalities in India : Steps taken by the

Government to reduce it.

Meaning of Economic and Social Development (HDI)

Human Development Index (HDI)

Human Poverty Index(HPI); it is replaced by Multidimensional Poverty in 2010

Multidimensional Poverty Index(MPI)

Characteristics of Indian Economy : Before and After Independence

Census of India : Economic and Social features

Characteristics of Indian Economy : Before and After Independence

The economic history of India shows a number of distinct phases over the period it fell under the colonial control to the modern times when it embarked on economic reforms. Before the formal onset of the British colonial rule in India after the battle of Plassey in 1757, India was among the richest countries of the world. According to some estimates during the Mughal period India was the second largest economy having a share of almost 25% of the world economy. Two centuries of the exploitative British colonial rule led to India's wealth being drained away and the process of 'deindustrialisation' taking a heavy toll on the people of India. The great nationalist leader Dadabhai Naoroji was the first person to systematically highlight this aspect of the colonial exploitation. His analysis laid the theoretical foundation for the freedom struggle culminating in India's independence in 1947.

At the time of independence, India inherited a stagnant economy. Between 1900-1950, the

real GDP growth rate of India was almost zero. The independent India embarked on a process of economic reconstruction and growth by adopting the model of planning. The beginning was made with the Mahalnobis-Feldman model which aimed to build the capital goods industry to lay the foundation for self-reliant growth in India.

However, beginning the 1980s winds of change had started blowing across the world in the form of greater international economic integration in the process of globalisation. India realised that its growth rate, sarcastically dubbed the 'Hindu growth rate' of close to 3% annually, was far too low to sustain the expanding aspiration of its people. The distortion in the planned economic process was glaringly reflected in the 'license-permit raj' that empowered the rent seeking class of bureaucrat-contractor-politician to extract surplus from the system. This was the period when economic reforms were initiated, prompted in no small measure by the expanding sphere of finance capital in the world economy.

The process of economic reforms picked up momentum by the early 1990s as India had to undergo structural adjustment in order to avoid defaulting on its international obligations towards debt repayment. The reforms moved apace to include opening up of the economy, decontrol and significant changes in the financial and banking sectors. The

transition from the public sector attaining the 'commanding heights of economy' to the 'market driven open economy' has been a complex and multi-layered process. The transition has indeed resulted in an accelerated GDP growth rate of above

5% for the period 1991-92 to 2003-04 and above 6% for the period 2003-04 to 2011-12. Fall in the poverty ratio, improvement in the FDI and better forex reserves have also been noticeable achievements of this period.

However, this period has also been marked by an increase in the level of inequality in the country. According to a study 'in both the early 1990s and the early 2000s the wealthiest 10% of wealth-holders held at least 50% of total assets, while the least wealthy 10% held at most 0.4% of total assets'. In case of land, it is more unequally distributed than wealth as a whole. The ownership of financial assets is even more concentrated, as 'almost all financial

wealth is held by well below 1% of the population'. It needs to be highlighted that inequality in resource endowment also culminates into inequalities of opportunity which defeats the purpose of inclusive development that India has adopted as a stated objective of its economic policy. There has also been a serious concern about employment generation in the period of economic reforms. The robust growth rate has not really been accompanied with improvement in the employment generation. Similarly, share of manufacturing sector in the GDP has also been quite low at 16%, putting a structural constraint on the future prospect of growth with employment.

Indeed, the rights based model of inclusive development could be successful only when we are able to bring in larger and larger number of people in the 'circuit of capital' for their productive integration in the process of creation of national wealth. After all, the famous economist Joan Robinson has rightly remarked that 'what is worse than being “exploited” is

not to be exploited at all!'

Economic Growth In India – Performance and Prospects

The most comprehensive indicator of economic growth in an economy is the average annual growth in real Gross Domestic Product(GDP) that is originating within the geographical boundary and measured at constant base period prices. It would, therefore, reflect average incremental availability of goods and services produced domestically in the economy over time. When the growth of real GDP is adjusted for the population growth, it gives the average annual growth of per capita real GDP and reflects closely the improvements in standard of living enjoyed by people in the economy on an average over time. This is particularly valid for large countries where the cross border flows of goods and services are limited in relation to the amount produced within the geographical boundary. These three average annual growth rates in: (i) real GDP, (ii) population and (iii) per capita GDP (PCI) are very significant parameters to reflect the performance and prospects of economic development in any country over fairly long time period.

History of economic growth in India is both interesting and educative. Comparable time series estimates of real GDP in India can be stretched back till the year 1900 for meaningful analysis (Sivasubramonian, 2004; and Hatekar & Dongre, 2005). There is considerable research on attempting periodization of the economic growth history in India to gain insights about policy regimes and factors determining the performance of the economy over long periods of time (Hatekar & Dongre, 2005; Balakrishnan & Parameswaran, 2007; and Dholakia, 2014). Accordingly, there are five distinct phases so far in the history of economic growth in India: (i) 1900-1901 to 1950-51; (ii) 1950-51 to 1980-81; (iii) 1980-81 to 1991-92; (iv) 1991-92 to 2003-04; (v) 2003-04 to 2011-12.

The growth performance during the first phase when the country was under the last 50 years of the British rule was the worst during all the phases so far. Real GDP grew at around 1 per cent annually and so did the population. As a result, the per capita real income almost stagnated for the first fifty years of the last century in India. Since the last fifty years of the British rule in the country were perhaps the best period for the Indian economy under their rule of about 190 years in terms of development of all physical and social overhead capital such as railways, ports, schools, colleges, hospitals, banks and other institutions, it can be safely assumed that the stagnation of real living standards of people observed during 1900-51 was perhaps the phenomenon during the entire period of 190 years of the British rule in the country. These two centuries of stagnation ensured that one of the richest countries in the world luring everybody by its wealth and prosperity turned into one of the poorest countries by the year 1950-51.

The stagnation of real per capita income for such a long time also had other implications. Under such circumstances, if anyone becomes better off, it cannot happen without someone else becoming worse off, because it becomes a zero sum game under stagnation. Therefore, in the society people started looking at progressing few with suspicion that they would have been involved in some wrong doing to become rich by depriving others or snatching opportunities from others making them poorer - a perception that continues even today! Social and cultural barriers to entrepreneurship became stronger and economic growth in the nation further suffered. Moreover, long stagnation in the living standard of masses implies that their consumption pattern would not change significantly, and because there would be hardly any innovations or technological progress in the system, people would continue to consume the same products throughout their life with little diversity and change. Rate of product obsolescence and depreciation was very small and the culture of preserving things by recycling, saving resources and using outdated technology with low material costs was widely prevalent.

After achieving independence, it was a major challenge to break out from such vicious circles of low level equilibrium. Committing ourselves to achieving self-sufficiency in general and the socialistic pattern of society by adopting both economic and physical planning through creation of public sector undertakings and imposing numerous controls, licenses and high taxes, during the second phase (1950-81) we achieved the breakthrough largely through public sector interventions. In terms of managerial decision to buy or make, the national commitment to self-sufficiency implied complete focus on import substitution without consideration to cost of production. It was consistent with the export pessimism subscribed by most of the leaders of those days. Although our share in world exports started falling significantly, the real growth of GDP increased to about 3.5 per cent annually over the 30 years period, 1950-81. Because of a sharp fall in the death rate due to improved provisioning of primary healthcare infrastructure in the rural areas, the growth of population also increased substantially to about 2.2 per cent annually and the per capita income registered annual growth of meagre 1.2 per cent. It marked an increase of about 2.5 percentage points in the annual growth of real GDP, but only about 1.2 percentage points in per capita real GDP.

The need for reforms in economic policies was duly recognized in India in the early 1980s, not substantially lagging behind China. Several economic reform measures got initiated during the 1980s with exchange rates adjusting continually for differences in the inflation rates, change in the approach of monetary policy to monetary targeting, instituting new institutions in financial sector, announcement of long-term fiscal policy, reducing quota requirements in selected commodities, focusing on telecom & information & technology sector, etc. The economic growth during the third phase( 1980-81 to 1991-92) further picked up from 3.5 per cent to 5.1 per cent annually and the population growth fell to about 2 per cent. Per capita real GDP, therefore, started growing at more than 3 per cent annually during the 1980s.

The fourth phase(1991-92 to 2003-04) saw accelerated pace of implementation of some systematic economic policy reforms in various segments of the economy such as fiscal policy, autonomy of the Reserve Bank of India (RBI), commercial policy, capital markets, aviation sector, banking and insurance sector, etc. Sequencing of the reforms was meticulously done starting with privatizing selected sectors by allowing participation by the private sector into those activities reserved hitherto for only the public sector undertakings, liberalizing economic activities by abolishing licensing requirements, gradually reducing protection by cutting tariff rates to integrate domestic economy with the international economy, allowing foreign direct investments in the economy and finally allowing domestic players to go global and become multinational companies. The growth of real GDP further increased during this phase to 6 per cent and per capita real GDP to more than 4 per cent annually.

During the last phase so far covering the period 2003-04 to 2011- 12, although no major economic reform took place, the economy was allowed to consolidate and adjust to the reforms already made initially for 5-6 years. However, during the last 4-5 years, some reforms got reversed effectively by introduction of new controls, regulations, approval requirements, bans, environmental and ecological balance oriented clearances and so on. Favourable global factors prior to the year 2008 coupled with easy monetary policy and movement towards fiscal consolidation resulted in high growth.

Annual growth of real GDP increased further to 8.4 per cent and per capita real GDP to more than 6.5 per cent. Interestingly, critical areas of pending reforms such as labour reforms, land market reforms, foreign direct investment, direct & indirect taxation reforms, expenditure reforms and so on are yet not satisfactorily addressed. These represent the opportunities for future growth of the economy.

Prospects For Indian Economic Growth

In the recent past, the best economic performance of the Indian economy was achieved during the year 2007-08. It is important to note some relevant parameter values during the year because they have been actually achieved by the nation in not too distant past and, therefore, can easily be achieved again. It represents the lower bounderies on the potential existing in the economy. In 2010-11, we came very close to achieving several of those parameter values, which indicates the feasibility and practicality of such a potential existing in the economy at present.

In 2007-08, the Indian economy clocked the growth of 9.3 per cent in real GDP at factor cost, exports growth of 29 per cent in dollar terms, inflation rates of 4.7 per cent (Wholesale Prices) & 6.2 per cent (consumer prices), foreign exchange reserves of $310 billion equivalent, average exchange rate of Rs. 40.3 per dollar, current account deficit of only 1.3 per cent of GDP, combined fiscal deficit of 4 per cent of GDP, combined revenue deficit of 0.2 per cent of GDP and primary surplus of 0.9 per cent of GDP. Thus, the year 2007-08 was outstanding in all relevant performance parameters except consumer inflation. This was made possible primarily because domestic savings rate and domestic investment rate reached their respective peaks at 36.8 per cent and 38.1 per cent of GDP. The Incremental Capital Output Ratio (ICOR) reflecting the efficiency of converting capital formation into growth of output was around 4.1.

The performance of the economy slipped on all these parameters sharply after the year 2007-08. International developments in terms of financial & confidence crisis of 2008, increase in commodity prices including oil prices, Eurozone sovereign debt crisis, etc. led almost all developed economies into severe recession and most of the developing economies to a significant slowdown. Both fiscal and monetary boosts were provided all over with a significant collaborative effort to emerge out of such a slump. Indian economy could fast recover and emerged out of the slowdown initially in terms of regaining the growth momentum, but failed to reign in the inflation, twin deficits on fiscal & current account, steep depreciation of the currency and loss in foreign exchange reserves. Public sector savings fell sharply from 5 per cent of GDP in 2007-08 to 1.3 per cent in 2011-12. Savings of the private corporate sector also fell from 9.4 per cent of GDP in 2007-08 to 7.2 per cent in 2011-12. As a result, overall savings rate in the economy fell by 6 percentage points to 30.8 per cent of GDP in 2011-12 from 36.8 per cent in 2007-08. Investment rate also fell from 38.1 per cent of GDP in 2007- 08 to 35 per cent in 2011-12 and 32.3 per cent in 2013-14; and the growth of real GDP came down to 6.2 per cent in 2011-12. ICOR increased to 5.6 indicating substantial deterioration in the efficiency of capital resources that can occur only if the investments remain under or unutilized.

The government’s failure to take several decisions of critical importance and urgency to ensure proper utilization of natural resources and capital investments in areas of strategic importance such as infrastructure provision, raw material supplies, taxation, providing environmental clearances, giving timely approvals for projects with huge investments, etc. resulted in sharply reducing capital efficiency and consequently increasing the ICOR in the system. From the economy’s potential assessment angle, all these factors are of temporary nature and can get reversed very fast. If the central government starts performing by taking quick decisions and clearing the pending cases of approvals, it may not only provide good incentives for additional investments from the private corporate sector but also lead to improvements in utilization rates of existing projects. All this can result in reducing the ICOR back to the level achieved in 2007-08. Similarly, the central government can reign in the fiscal discipline soon to ensure a rise in the public sector saving back to the level of 2007-08.

Thus, achieving the domestic savings rate of 36.8 per cent in near future is very likely. Then, attaining the investment rate of 38 per cent is also quite feasible. However, the future potential of India is far more attractive, because India is among the few economies currently in the world enjoying the demographic dividend. The proportion of population in the employable age group of 20 years to 65 years is on the rise in the country and is likely to continue rising till about 2027-28 as per the UN projections. Thereafter it may stabilize for a while and then start falling. To attain the current level of the ratio, it may take another 15-20 years because the life expectancy in the country is also likely to rise in the meantime, but the further rise would be necessarily slower as we achieve higher levels. Since the dependency ratio would be falling in the country till 2027-28, domestic savings rate is most likely to rise further to reach the levels already reached in south-east Asia of 40-42 per cent of GDP. If the efficiency of capital resources is maintained with the ICOR staying at 4.1, this in itself would generate an annual growth rate of 10 per cent of real GDP. This is purely domestically funded growth potential. We expect that such a high growth momentum is most likely to attract huge foreign investment in search of better returns and dynamic markets. Similarly our companies would reach out to foreign destinations to expand their markets. If we assume a net inflow of only 2 per cent points, it would push our annual growth potential upward to 10.5 per cent over a fairly long period unto 2050.

Population growth rate is likely to slow down considerably and would be about annual 1 per cent on average. Then the per capita real GDP is likely to grow at around 9 per cent annually. This is a mind-boggling scenario where the per capita real income would be doubling every 8 years. The availability of goods and services would be increasing at an unprecedented rate and so would be the consumption of people. With such a high speed of expansion in the consumption basket, the consumption pattern would be changing drastically and rapidly. The basket would be highly diversified and ever changing. Rate of product obsolescence and depreciation would be very high. Preserving goods would not be found viable and feasible. Recycling of products and resources could become a formal business but affording it within the household could be almost ruled out. Service sector, entertainment, information, communication, research and development are the fields most likely to come to prominence. In short, the first fifty years of the current century are likely to be quite opposite to the first fifty years of the last century in India.

In such a dynamic and fast pace of economic growth, entrepreneurship and diversity of consumption would require considerable resources devoted to research and development. This would require qualitatively a much superior human resource development strategy. For a business enterprise, to survive and maintain one’s relative position, rapid growth in labour productivity, technological improvements and emphasis on exclusive products would be the key. Emphasis and reliance on the private sector participation is likely to address most of these concerns as a part of their self-interest.

Is India back to the Hindu Growth Rate?

India’s post economic reforms growth has been one of the most cited examples by economists in last many years. A h l u w a l i a ( 1 9 9 5 ) , Srinivasan (2002), Stern (2004), Virmani (2004), Tendulkar and Bhavani (2007), Panagariya (2008), Bhagwati and Panagariya (2012.) to name a few are among some of the leading contributors in this regard. India was blamed for its inwardlooking industrialization from 1950-90. Growth got a new boost from India’s macroeconomic reforms when it moved from inward looking to outward looking industrialization. This was in anticipation of the policy makers that Indian economy would achieve faster economic growth. But, the growth in the post reforms period has become a matter of debate. Economists argue that India is an open economy where the Hindu Growth Rate is far from the reality. To get an external linkage in this particular paper, the Pearson correlation coefficient (r) finds the strength of the linear relationship between the GDP Growth and trade deficit in India.

Growth Rate vs. Hindu Growth Rate

Economic growth is defined as the steady process by which the productive capacity of the economy is increased over time to bring about rising levels of national output and income (Todaro and Smith, 2003). Samuelson and Nordhaus (2007) assert that economic growth represents the expansion of a country’s potential GDP or national output. Soon after the independence, Indian Economy was facing chronic imbalances as part of colonial rule. Indian economy was left with weak industrial base, poor infrastructure and static economy. India made the first declaration of industrial policy in theirresolution dated 6th April, 1948 in which both public and private sectors had been given importance.

India followed the planning model that was adopted in socialist countries including former USSR. In tune with the socialist central planning model, India started its planning beginning from 1951. However, the development of industries was left in shadow during first five year plan. The gloomy picture of industrialization and sub normality as part of industrial development can be traced through the facts. According to the 1st Five Year Plan, on the one hand, factory establishments in the country accounted for merely 6.6 per cent in 1948-49 as a proportion of national income and on the other, only 1-8 per cent of the working population were engaged in these establishments.

A new industrial policy statementwas announced on 30th April, 1956 (The Industrial Policy of year 1956 is known as ECONOMIC CONSTITUTION of the country.). It was aimed at accelerating the process of industrialization and specifically developing large scale heavy industries. The new revised industrial policy includes Schedule A and Schedule B. Schedule A included industries which were the exclusive responsibility of the state - monopoly of the state. Schedule B included mixed sector of public and private undertakings. All the rest of the industries were left for the private sector to establish and operate.

The Second Plan(1956-61) was particularly in the development of the public sector. The plan followed the Mahalanobis model, an economic development model developed by the Indian statistician Prasanta Chandra Mahalanobis in 1953. Hydroelectric power projects and five steel plants at Bhilai, Durgapur, and Rourkela were established. Coal production was increased. More railway lines were added in the north east.The Tata Institute of Fundamental Research was established as a research institute.

The Third plan(1961-66) was largely devoted to long run benefits and was in tune with the objectives of increase in the national output and income generating huge employment. The focus was on the development of capital and producer goods industries. It also emphasized on the development of machine-building industries. However, the growth rate of industrial output declined, initially at slow pace and after that, it decelerated sharply reaching stagnation levels. This created serious concerns for nearly three years when the economy fluctuated. The year 1968-69 showed a clear sign of recovery. Fourth Five Year Plan (1969-74), was marked by a very low growth in industrial production of 3.9 per cent against the targeted rate of 8-10 per cent.

Fifth Five Year Plan(1974-79), started in 1974, proposed to achieve growth with the attainment of self-reliance. The emphasis was on the industries of core-sector like- iron & steel, nonferrous metals, fertilizers, mineral oil, machinery-building, coal and others. The economy was faced with pressures and the industrial growth rate was low at 2.5 per cent in 1974-75. It was 5.7 per cent in 1975-76 which provided some relief for the economy.

Sixth Five Year Plan(1980-85) was started in 1980. Substantial policy changes were announced during this plan. The Sixth Five-Year Plan marked the beginning of economic liberalisation. Price controls were eliminated and ration shops were closed. This led to an increase in food prices and an increase in the cost of living. This was the end of Nehruvian socialism. Industriallicensing and controls were relaxed and import policy was more liberalized than ever before. The result was that growth was witnessed in industrial production. Seventh Five Year Plan was started in 1985.The emphasis was on development with growth and increase in productivity. The industrial growth rate during this plan was 8.5 per cent against the target of 8.4 percent. Thus, it was successful on the part of industries.

Ahluwalia (1995) pointed out that the inadequacy of the growth performance of the Indian economy led Prof. Raj Krishna to coin the much quoted phrase 'the Hindu rate of growth, to specify the disappointing trend of growth. The Hindu growth rate has nothing to do with any specific religion; rather it is a term that was economic in nature. It was a caustic remark on the socialist pattern that was adopted by the government after the Independence. It was an indication of low and almost stagnant growth of Indian economy during 1950s to 1980. The average annual growth rate of GDP during this period was 3.5 per cent. The growth rate of GDP has shown in table1:

GDP growth rate from 1950-1979

Decades GDP growth Rate

1950-59 3.3

1960-69 4.4

1970-79 2.9

1950-79 3.5

Virmani (2004), asserts that the new economic policy introduced in 1991-92 had changed the Indian economy and pushed it from the Hindu rate of growth to a new higher rate of 5 per cent-6 per cent, called as, new Hindu rate of growth.

Slow-down Growth Linkages

Growth potential of Indian economy can be gauged in two ways: quantitative and structural. To understand the quantitative aspects, growth rates of different sectors and overall GDP growth are considered. But to understand the economy well, structural aspects have to be considered. Changes in sectoral distribution of GDP give the more realistic account on the part of economic growth of the country. Agriculture dominated the sectoral composition of the GDP till 1970. In 1950-51 agriculture and allied sector’s share in GDP was 55.3 per cent. Two decades of planning in India, did not show any significant decline in the share of agriculture and allied sector. This was the manifestation of the fact that industries were indeed in a bad condition in India. The process of industrialization was not smooth and not contributing significantly.

Growth Trends after Reforms

The crisis of 1991 led the Indian policy makers to think beyond the policy of import substitution to outward oriented export promotion model. The Indian economy was integrated with the economies of the world. Reforms were initiated in industrial policy and foreign investment policy, trade and exchange rate policy, tax reforms, public sector policy, financial sector reforms, reforms in agricultural sector, labor market reforms and others. The results of these reforms were seen soon after the reforms. The GDP growth rate which was merely 1.43 per cent in 1991-92, increased to 5.36 per cent in 1992-93.

Agriculture & Allied Sectors

Indian economy was heavily based on agriculture. Its importance can be evaluated on two grounds- share in GDP and in employment. So there is a need to address the problems of agriculture. The low production and productivity poses constraints on the total output of agriculture. The inefficiency on the part of agriculture merits sound policy implications and investments. A very alarming characteristic of agricultural sector is that real investment in agriculture, both private and public, has been stagnant (Ahluwalia, 1993). This, with other structural factors, led to slow growth in agricultural and allied sector.

Industry

The economic reforms were more radical as far as industries were concerned. Changes in the policy framework gave a big boost to industries. The major reforms were the abolition of licenses to a wide range of industries. Licenses are required now only for some industries. Industries have thus grown significantly during the last two decades after the reforms. Average growth rate from 1991-92 to 2010-11 was 5.7 per cent with a peak growth of 12.17 per cent in 2006-07 and lowest of 0.34 per cent in 19991-92.

Service Sector

The service sector in India after the reforms has dominated the sectoral composition of GDP. The share of services in 1991-92 was 43.9 per cent which rose to 59.29 per cent in 2012- 13.There is a sharp increase in IT, telecom, banking service, insurance, entertainment and many more. But, it’s also true that only few services are performing well. Today, India is well known for IT and IT-enabled services (ITES), communication and BPO. The growth of service sector after the reforms shows a relatively smooth trend compared to agriculture and industries. The growth rate which was 4.69 per cent in 1991-92, started increasing and witnessed double-digit growth in several years.

Performance of Indian Economy

There are different phases of growth of Indian economy. Before 1980s, there was relative stagnation in the economy, with average growth rate of GDP at 3.5 per cent. Partial reforms were started during 1980s. But total reforms were initiated only after 1991. The currency crisis of 1990s compelled the policy makers to initiate the reforms. GDP started peaking after reforms.

External Linkages

Domestic sectors have been discussed till now. To analyze the economy completely, it is imperative to understand the external linkages of growth also, comprising exports and imports. Trade balance remained negative since long. There has been trade deficit in the balance of payments account. Below diagram shows trade balance and GDP growth rates from 1957 to 2015.

The correlation coefficient between GDP growth rate and trade deficit is found to be 0.58. This indicates that there is a moderate positive relationship between these two. The value of correlation coefficient shows that when GDP increases, India’s trade deficit also increases (though moderately), indicating that the exports are not responding as fast as compared to imports. These growth rates indicate that the reforms had certainly brought more imports which has contributed in our growth because such range of growth rate (1991-2010) has not been achieved by India before trade liberalization started in 1991.

Recent Growth Trends

The Indian economy is facing problems that are reflected through the facts released by the Ministry of Finance, Department of Economic Affairs during recent couple of years. Quarterly data released from 2010-11 to 2012-13 related to the growth rates of agriculture & allied sector industry and service sector have been shown in Table 5. Agriculture & allied sectors have been performing poorly. This is the most fluctuating sector – growth rates have fluctuated between peak rates of 11.0 per cent in quarter 3 (Q3) of 2010-11 to mere 1.2 per cent in quarter 2 (Q2) of 2012-13. Average growth rate during this period was 3.4 per cent. Industrial sector is also a matter of concern for the policy makers and the government. Industries have grown on an average of 4.4 per cent during Q1 of 2010-11 to Q2 of 2012-13. However, service sector shows a steady trend during this period. Average growth rate in this sector stood at 8.6 per cent. Overall GDP growth rate during this period was 6.9 per cent.

Conclusion

Compared to the pre reforms era, Indian economy had much faster economic growth in the post reforms period. But, the recent revised forecasts released by ADB and others on the growth of Indian economy provide a glimpse of slow down of Indian economy. Agriculture and allied sector is still a matter of concern as it is the most fluctuating sector in the Indian economy.

No comments:

Post a Comment